The $150 Billion Industry No One Likes

(non payroll employee payments)

Every manager has felt the frustration. Your team had a great month and you want to buy them a little gift to show your appreciation. You buy everyone a $20 Starbucks gift card. That should be the end of it, but instead that’s just the beginning. That simple gesture has kicked off a chain reaction of paperwork – What is it for? What budget does it come out of? How much have you spent on gift cards this quarter?

Further, that gift card probably doesn’t have the intended impact with the employee. One person doesn’t drink coffee at all. Another doesn’t have a Starbucks near them. One puts the card in a drawer where it will stay undisturbed for several years.

New research from Whistle found that the average people manager in the US spends $774 per month on non-payroll disbursements. Examples include gifts for holidays and birthdays, expenditures for employee engagement, and small expenses like lunch or happy hour. Extrapolated across the 16 million people-managers in the US, means there is $150 billion spent annually on non-payroll disbursements and payments.

Given this size, one might assume that it’s a frictionless process, but that could not be further from the truth. 98% of managers say they are frustrated with payments. The most common reason is staying within budget (56%), followed by the time delay to getting the money (47%), employees would rather have cash than gift cards or physical items (47%), and tracking how much you’re spending (46%).

Payments are Everywhere and Nowhere All at Once

Whistle’s research looked at non-payroll disbursements across three broad categories: gifts, expenses, and rewards. Whistle’s research found these are extremely common behaviors for managers, and yet these small disbursements are not being consistently tracked, meaning their cost and effectiveness are unknown.

Gifts

Giving an employee a gift may not technically be a part of the compensation package, but successful managers show their employees recognition beyond a “pat on the back” and give their employees something of value, even if small. Whistle’s research found that 45% of managers are giving 3-5 of these small gifts per month, with 20% giving six or more per month. Usually, the value is between $50-$100.

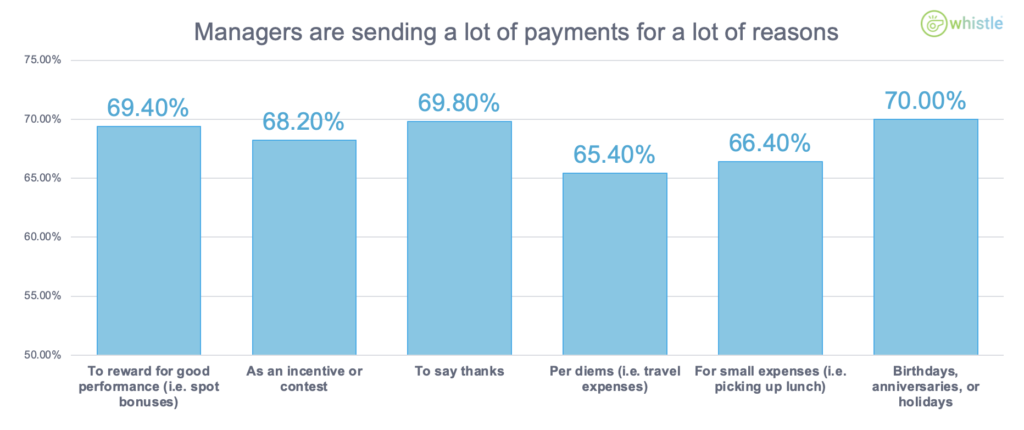

70% of managers give gifts for birthdays, anniversaries, holidays, or just to say thanks. These are being given in a variety of ways – gift cards, cash cards, or physical items. Despite this variety, these same managers report their employees are more likely to want cash.

Expenses

Most major expenses, such as equipment or travel, are facilitated through a traditional reimbursement process, usually a corporate card. However, there are small expenses that managers often pay for, which fall into a gray area. The manager wants to pay for a few rounds at a happy hour, or give the intern some cash to pick up lunch for the team.

66% of managers say they give cash or cards for small expenses for their team. 65% say they use these kinds of disbursements to cover travel expenses.

Rewards

Sales professionals earn commissions that are taken care of through payroll. However, there is a whole hidden industry of incentives and employee rewards that happen offline. Buying a gift card for closing a deal. Giving everyone on a team a little cash as a reward for meeting a tough deadline. Whistle’s research found 93% of managers are giving these kinds of small rewards and incentives, with 66% giving at least three per month. Most of the time these rewards are at least $50.

Herding Cats

Across all uses, the average people manager is spending $774 per month on these non-payroll disbursements. This gray-area spend is not a rounding error to be eliminated. Far from it. This spend is essential and useful. Sometimes a $20 gift or a $200 reward can make a huge difference in the performance and morale of a team. Managers should be doing more of these one-off payments, not less.

The issue is efficiency and transparency – how much is the manager spending and is that spend efficient? How many gift cards are going unredeemed? How many tchotchke gifts would employees rather have as cash? Do these gifts and rewards improve downstream retention and performance? Today, these disbursements are often more trouble than they are worth, especially for managers with many direct reports.

A common frustration for these managers is tracking how much they are spending. For managers with less than five direct reports, 22% say this is a frustration. That jumps to 40% for managers with 5-9 direct reports and 52% for managers with 10-19 reports.

Three Things Managers Can Do Today

The opportunity is clear. Today’s methods for a manager getting value in the hands of their employees is rife with waste and red tape, to the tune of $150 Billion annually in the US. It doesn’t have to be this way. Here are three steps for managers who want to improve disbursements to their employees:

- Be honest with yourself about what kinds of gifts your employees want. Your tastes are not going to perfectly align with your employees. That coffee mug or t-shirt might go right from the wrapping paper to their trash can. Make your personal connection through a heartfelt message or conversation, but do it in a timely manner. Timing of recognition is more important than what you give, so real time payments are ideal. And the majority of employees prefer cash anyway.

- Pick up the check often. Buying a team lunch or paying for an outing is a simple way to show your employees that they are valued. Small, frequent gestures are a great way to help employees feel engaged and appreciated – boosting retention and productivity. These small expenses can add up, but they are nothing compared to the value created or expense of filling a position.

- Take advantage of new technology like Whistle. Giving money and creating spending budgets for employees is not only easy to administer, but can produce better business outcomes. More time spent creating value and less time managing paperwork or cumbersome processes.

Jesse Wolfersberger is big data and AI thought leader, a Co-founder and advisor to Whistle, and the Head of Data at Invisibly. He was formerly the Chief Data Officer for one of the largest travel and incentive companies in the world and a consultant with several major league baseball teams.

Whistle helps companies make better investments in people to improve retention, productivity, and profitability. The Whistle platform integrates patent pending payment and microlearning tools with AI and business intelligence so companies can investment in, measure and continually improve the value of their people programs.