The 5 Pitfalls of Corporate Gift Cards

And what you should be doing to avoid them

Corporate gift cards are one of the most popular tools for employers attempting to create an element of employee loyalty. $188 billion will be spent on gift cards in the US in 2022. Gift cards appear to be the right balance of something personal, yet easy and simple. Unfortunately, these cards come with a lot of problems. Here are six factors to consider before giving away gift cards to your staff or partners:

1. Fees for the privilege.

Many gift cards charge an up-front fee. A recent survey of 62 gift cards by Bankrate.com found that general purpose gift cards charge purchase fees ranging from $3.95 to $6.95. The smaller the gift card value, the higher percent you’re paying for the gift card in fees.

Check on monthly maintenance fees that are charged if the gift card isn’t used after some time period. Bank and credit card-issued gift cards are the most likely to charge this type of fee. The worst offenders are the payment companies. Typically, they will charge a fee after a few months until they destroy all value remaining on the gift card.

2. Use them or lose them.

Even the most consumer-friendly rules can’t protect employees from their own forgetfulness. If a gift card gets tucked away in a drawer it’s not creating value. It’s also not reinforcing the behavior that earned the card. This is called “breakage”. Up to 20% of cards expire each year. In 2022, there are $15 billion in unused gift cards waiting for some attention. Bankrate found that millennials are more than twice as likely to lose physical gift cards than older generations. When an employee realizes their gift card can’t be used it can feel worse than not getting anything.

3. Take advantage of extra security perks.

Gift cards can be more secure than simply giving cash, since some gift card issuers offer to replace cards if they are lost or stolen. Even more secure are companies who provide payment cards that can be replaced for free. With gift cards, recipients have to register their cards in advance, so be sure to read the fine print that comes with the cards and take any necessary steps. This can be a hassle for your staff.

card issuers offer to replace cards if they are lost or stolen. Even more secure are companies who provide payment cards that can be replaced for free. With gift cards, recipients have to register their cards in advance, so be sure to read the fine print that comes with the cards and take any necessary steps. This can be a hassle for your staff.

4. Know where your employees or partners like to shop.

Since store-branded gift cards tend to come with fewer fees than bank or credit card-branded ones, gift card givers can save money by purchasing store-specific cards, as long as they know the shopping habits of the person they are gifting. For example, Target gift cards work well for some budget-minded staff and Amazon gift cards for online shopping lovers. Unfortunately, it can be very difficult to know which is which. Often, companies give cards based on what they think staff like, only to realize their mistake after the fact.

It’s also very difficult to stand out among a sea of gift cards. When an employee gets one more Starbucks gift card, it often goes into the pile of gift cards. The colleague you wanted to thank immediately forgets where the card came from or what inspired the gift. An entire industry has grown to help people organize their stacks of gift cards.

5. Look out for gift card rules.

Gift cards feel easy and simple. The truth is they can be complex. Because they are small and super portable, they can easily be lost or, unfortunately, stolen. Few companies keep close track of gift cards. Many keep a stack of them in a drawer. Finance organizations don’t have a line item for gift cards, so they get lumped into another cost bucket without clear tracking and reporting. Many companies are not even aware of the cost of gift cards throughout the enterprise. These elements create a scenario where companies can accidentally become guilty of failing to account properly for both the cost.

Employees also must pay taxes on gift cards. Companies rarely account for the tax implications of giving gift cards, which can become a problem, especially when no one knows how much is actually being given out.

Conclusion

When you are considering, or re-considering a corporate gift card program keep these elements in mind.

Work with a payment solutions provider that doesn’t charge any purchase fees. They are out there. Payment solutions companies typically make money on breakage. That economic incentive is diametrically opposed to your goals. That provider makes more money when your staff lose or misplace their cards. Find a better partner who is aligned to your goals.

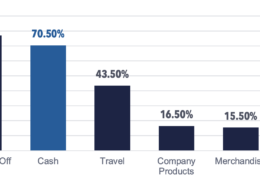

Don’t get fooled by the red-herring claim that “my program has the most gift cards”. This is silly and doesn’t matter. What employees want is flexibility. Work with a partner that provides a payment card that can be used anywhere. Your staff doesn’t want another Outback Steakhouse gift card.

While employees want flexibility, they also really appreciate the “gift” concept. Work with a partner that allows you to send a cup of coffee, for example, but doesn’t require a Starbucks gift card. Send the cup of coffee tells your staff you see them and have an idea of what they might appreciate. Keeping the payment card flexible allows your staff to buy the coffee wherever it makes sense. You and your team get the best of both worlds!

Forget the Bells. You Just Need Whistle.

Overwhelmed? Let us help you build a better onboarding experience, improve leadership training, or find innovative ways to appreciate your people — start by speaking to a consultant for free.

Additional posts you might find interesting

/wp-content/uploads/2025/04/FI-Haugland-Group-Case-Study.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2025-04-30 20:53:522025-04-30 20:53:52Haugland Improves Procore Use by 200%

/wp-content/uploads/2025/04/FI-Haugland-Group-Case-Study.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2025-04-30 20:53:522025-04-30 20:53:52Haugland Improves Procore Use by 200%

Improving Mental Health in Construction: How Recognition and Rewards Can Save Lives

/wp-content/uploads/2025/04/FI-Whistle-Forms.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2025-04-28 17:58:512025-04-28 17:58:51Whistle Forms: Compliance Made Easy

/wp-content/uploads/2025/04/FI-Whistle-Forms.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2025-04-28 17:58:512025-04-28 17:58:51Whistle Forms: Compliance Made Easy

5 Ways Safety Leaders Can Boost Employee Retention

Company Merchandise Stores

/wp-content/uploads/2025/01/FI-Photo-Uploads-for-Recognition.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2025-01-12 21:53:032025-03-05 00:33:30Whistle Rewards Launches New Photo Uploads Feature

/wp-content/uploads/2025/01/FI-Photo-Uploads-for-Recognition.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2025-01-12 21:53:032025-03-05 00:33:30Whistle Rewards Launches New Photo Uploads Feature

Transforming Safety Culture with Whistle Rewards

/wp-content/uploads/2024/12/FI-AI-powered-recognition.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-12-12 19:07:322024-12-12 19:40:44Whistle Rewards’ New AI-Powered Recognition Assistant

/wp-content/uploads/2024/12/FI-AI-powered-recognition.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-12-12 19:07:322024-12-12 19:40:44Whistle Rewards’ New AI-Powered Recognition Assistant

Why Rewards Work So Well with Project Management Tools in Construction

23% of construction companies plan to add more monetary rewards in 2025

Using Paychecks for Recognition is a Waste

How Technology Will Reshape the Construction Workforce in the Next Five Years

Shannon Construction increases Daily Log reporting in Procore by 863%!

/wp-content/uploads/2024/10/FI-Use-QR-codes-to-easily-send-group-rewards.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-10-01 12:40:562024-10-01 12:40:56Scan QR codes to add people to a spot reward group

/wp-content/uploads/2024/10/FI-Use-QR-codes-to-easily-send-group-rewards.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-10-01 12:40:562024-10-01 12:40:56Scan QR codes to add people to a spot reward group

Smartphones: A better way to engage

/wp-content/uploads/2024/09/FI-Case-Study-Korte-Safety-Reporting.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-09-01 13:42:572024-12-08 22:51:03Korte Boosts Safety Reporting by 50%

/wp-content/uploads/2024/09/FI-Case-Study-Korte-Safety-Reporting.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-09-01 13:42:572024-12-08 22:51:03Korte Boosts Safety Reporting by 50% /wp-content/uploads/2024/08/FI-Employee-Rewards-frequency-matters-more.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2024-08-26 17:17:592024-09-12 15:02:07Employee Rewards: Frequency matters more

/wp-content/uploads/2024/08/FI-Employee-Rewards-frequency-matters-more.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2024-08-26 17:17:592024-09-12 15:02:07Employee Rewards: Frequency matters more /wp-content/uploads/2024/08/FI-Case-Study-Reducing-Rewards-Program-Waste.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2024-08-23 21:20:102024-08-28 15:14:51Reducing reward waste by 50%

/wp-content/uploads/2024/08/FI-Case-Study-Reducing-Rewards-Program-Waste.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2024-08-23 21:20:102024-08-28 15:14:51Reducing reward waste by 50%

Whistle Rewards Selected to Join Google AI Academy for American Infrastructure

Why Rewarding Your Construction Staff Is More Than Just “Paying Twice”

Behavioral Science in the Construction Industry: Avoiding the Boomerang Effect

/wp-content/uploads/2024/08/FI-Case-Study-better-learning-incentives.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-07-27 16:32:192024-08-28 15:42:09Learning Incentives Save Time and Money

/wp-content/uploads/2024/08/FI-Case-Study-better-learning-incentives.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-07-27 16:32:192024-08-28 15:42:09Learning Incentives Save Time and Money

Whistle Rewards: BuiltWorlds 2024 Start-up Competition Winner!

Upload Funds To Your Whistle Rewards Account

/wp-content/uploads/2024/07/FI-The-Ugly-Truth-about-Gift-Cards.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2024-07-14 19:01:272024-07-14 19:01:27The Ugly Truth About Gift Cards

/wp-content/uploads/2024/07/FI-The-Ugly-Truth-about-Gift-Cards.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2024-07-14 19:01:272024-07-14 19:01:27The Ugly Truth About Gift Cards

Reducing Employee Turnover by 26% in 30 Days

/wp-content/uploads/2024/06/FI-Crowding-in-motivation.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-06-05 19:40:462024-06-05 19:40:46Crowding-in Motivation for Lasting Impact

/wp-content/uploads/2024/06/FI-Crowding-in-motivation.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-06-05 19:40:462024-06-05 19:40:46Crowding-in Motivation for Lasting Impact /wp-content/uploads/2024/04/FI-Incentives-avoiding-entitlement.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-04-17 22:20:382024-04-17 22:20:38Incentives: Avoiding Entitlement with these 3 steps

/wp-content/uploads/2024/04/FI-Incentives-avoiding-entitlement.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-04-17 22:20:382024-04-17 22:20:38Incentives: Avoiding Entitlement with these 3 steps /wp-content/uploads/2024/04/FI-Birthday-and-Service-Anniversary-Rewards.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-04-11 20:45:052024-04-11 20:45:05Whistle’s New Birthday and Service Anniversary Rewards

/wp-content/uploads/2024/04/FI-Birthday-and-Service-Anniversary-Rewards.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-04-11 20:45:052024-04-11 20:45:05Whistle’s New Birthday and Service Anniversary Rewards /wp-content/uploads/2024/04/FI-5-concepts-shaping-whistle-rewards.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-04-02 20:33:482024-04-17 14:09:535 Concepts That Shape Whistle Rewards

/wp-content/uploads/2024/04/FI-5-concepts-shaping-whistle-rewards.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-04-02 20:33:482024-04-17 14:09:535 Concepts That Shape Whistle Rewards /wp-content/uploads/2024/04/FI-Cash-is-king.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-04-02 16:58:332024-04-02 16:58:33Why Cash is King for Construction Safety Incentives

/wp-content/uploads/2024/04/FI-Cash-is-king.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-04-02 16:58:332024-04-02 16:58:33Why Cash is King for Construction Safety Incentives /wp-content/uploads/2024/03/FI-How-To-Send-a-Spot-Reward-in-Procore.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-03-21 03:42:242024-06-14 15:33:38Send a Spot Reward in Procore

/wp-content/uploads/2024/03/FI-How-To-Send-a-Spot-Reward-in-Procore.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-03-21 03:42:242024-06-14 15:33:38Send a Spot Reward in Procore

Add Incentives to Procore Submittal Log to Boost Profitability and Safety.

/wp-content/uploads/2024/02/FI-Combatting-Burnout-in-Healthcare.png 418 576 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-02-25 13:16:362024-02-25 13:18:55Combating Burnout in Healthcare with Rewards and Recognition

/wp-content/uploads/2024/02/FI-Combatting-Burnout-in-Healthcare.png 418 576 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-02-25 13:16:362024-02-25 13:18:55Combating Burnout in Healthcare with Rewards and Recognition /wp-content/uploads/2024/02/FI-harnessing-the-power-of-rewards-in-construction.png 418 576 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-02-24 00:43:172024-03-24 13:23:00Harnessing the Power of Timely Rewards in Construction

/wp-content/uploads/2024/02/FI-harnessing-the-power-of-rewards-in-construction.png 418 576 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-02-24 00:43:172024-03-24 13:23:00Harnessing the Power of Timely Rewards in Construction /wp-content/uploads/2024/02/FI-Social-Recognition.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-02-21 22:58:482024-02-24 00:50:53Whistle Reward’s New Recognition Tools

/wp-content/uploads/2024/02/FI-Social-Recognition.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-02-21 22:58:482024-02-24 00:50:53Whistle Reward’s New Recognition Tools /wp-content/uploads/2024/04/FI-incentives-versus-rewards.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-02-03 20:42:142024-04-03 21:18:05Incentives versus Rewards

/wp-content/uploads/2024/04/FI-incentives-versus-rewards.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-02-03 20:42:142024-04-03 21:18:05Incentives versus Rewards /wp-content/uploads/2024/01/FI-FAQs.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-01-05 16:07:132024-03-29 15:15:13New Client Frequently Asked Questions

/wp-content/uploads/2024/01/FI-FAQs.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-01-05 16:07:132024-03-29 15:15:13New Client Frequently Asked Questions /wp-content/uploads/2024/01/FI-How-To-add-Whistle-Rewards-to-Procore.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-01-01 12:12:382024-04-03 22:08:43Add Whistle Rewards to your Procore Account

/wp-content/uploads/2024/01/FI-How-To-add-Whistle-Rewards-to-Procore.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2024-01-01 12:12:382024-04-03 22:08:43Add Whistle Rewards to your Procore Account /wp-content/uploads/2024/03/FI-How-To-Improve-Safety-Incedent-Reporting-in-Procore.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-12-15 16:43:012024-06-14 15:35:08Improving Safety Incident Reporting in Procore

/wp-content/uploads/2024/03/FI-How-To-Improve-Safety-Incedent-Reporting-in-Procore.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-12-15 16:43:012024-06-14 15:35:08Improving Safety Incident Reporting in Procore /wp-content/uploads/2023/11/Gratitude-w-title-narrower.png 450 583 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-11-19 01:44:372023-11-19 01:51:52Tis the Season to Be Jolly and Practice Gratitude

/wp-content/uploads/2023/11/Gratitude-w-title-narrower.png 450 583 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-11-19 01:44:372023-11-19 01:51:52Tis the Season to Be Jolly and Practice Gratitude

The Right Tool for the Job: Improving Construction Projects Using Rewards and Incentives

/wp-content/uploads/2023/10/Screenshot-2023-10-16-at-12.24.20-PM.png 950 1244 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-10-16 17:01:322023-10-16 17:01:32Simplifying Rewards to Boost Retention and Engagement

/wp-content/uploads/2023/10/Screenshot-2023-10-16-at-12.24.20-PM.png 950 1244 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-10-16 17:01:322023-10-16 17:01:32Simplifying Rewards to Boost Retention and Engagement

Building Great Cultures in a Post-Pandemic Era of Hybrid Work and Rapidly Changing Technology

The Irrefutable Carrot Conundrum: Why Positive Reinforcement Triumphs in the Workplace

The Carrot Chronicles: 12 Commandments of Influential Employee Rewards and Recognition

/wp-content/uploads/2023/08/Screenshot-2023-08-21-at-5.56.59-PM.png 984 1372 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-08-21 20:51:222023-08-21 22:59:27Creating Employee Loyalty with Corporate Philanthropy

/wp-content/uploads/2023/08/Screenshot-2023-08-21-at-5.56.59-PM.png 984 1372 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-08-21 20:51:222023-08-21 22:59:27Creating Employee Loyalty with Corporate Philanthropy /wp-content/uploads/2023/07/Screenshot-2023-07-14-at-10.34.33-AM-1.png 702 877 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2023-07-14 15:13:002023-07-14 16:16:50Maximizing Employee Retention in the Banking Industry

/wp-content/uploads/2023/07/Screenshot-2023-07-14-at-10.34.33-AM-1.png 702 877 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2023-07-14 15:13:002023-07-14 16:16:50Maximizing Employee Retention in the Banking Industry /wp-content/uploads/2023/07/Screenshot-2023-07-13-at-10.57.02-AM.png 498 622 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-07-13 15:33:292023-07-13 16:00:14The Importance of Timely Rewards in the Banking Industry

/wp-content/uploads/2023/07/Screenshot-2023-07-13-at-10.57.02-AM.png 498 622 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-07-13 15:33:292023-07-13 16:00:14The Importance of Timely Rewards in the Banking Industry /wp-content/uploads/2023/07/Screenshot-2023-07-13-at-11.01.25-AM.png 550 688 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2023-07-13 02:20:122023-07-13 16:04:03Why Incentives Fail

/wp-content/uploads/2023/07/Screenshot-2023-07-13-at-11.01.25-AM.png 550 688 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2023-07-13 02:20:122023-07-13 16:04:03Why Incentives Fail /wp-content/uploads/2023/06/FI-Bank-are-missing-the-mark.png 359 540 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-06-14 02:29:452023-06-14 02:40:35Banks are missing the mark on employee loyalty

/wp-content/uploads/2023/06/FI-Bank-are-missing-the-mark.png 359 540 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-06-14 02:29:452023-06-14 02:40:35Banks are missing the mark on employee loyalty /wp-content/uploads/2023/05/Custom-dimensions-1600x900-px-Custom-dimensions.jpeg 1440 1880 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-05-11 16:41:062023-05-11 16:42:14Making Employee Retention Personal: Meaning

/wp-content/uploads/2023/05/Custom-dimensions-1600x900-px-Custom-dimensions.jpeg 1440 1880 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-05-11 16:41:062023-05-11 16:42:14Making Employee Retention Personal: Meaning /wp-content/uploads/2022/08/FI-the-5-pitfalls-of-corporate-gift-cards.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2023-04-27 21:19:432023-05-03 16:32:51The 5 Pitfalls of Corporate Gift Cards

/wp-content/uploads/2022/08/FI-the-5-pitfalls-of-corporate-gift-cards.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2023-04-27 21:19:432023-05-03 16:32:51The 5 Pitfalls of Corporate Gift Cards

SMS Text Feature makes Whistle the easiest employee payments and reward tool ever

The Importance of Aligning Company Values with Business Trajectory

The Importance of Measuring Gender Inclusivity in the Workplace

Creating a Sense of Belonging For your Employees

/wp-content/uploads/2023/03/Custom-dimensions-80x80-px-Logo-Custom-dimensions.jpeg 740 920 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-03-06 19:01:362023-03-06 19:05:36BankTalentHQ Announces Partnership with Whistle

/wp-content/uploads/2023/03/Custom-dimensions-80x80-px-Logo-Custom-dimensions.jpeg 740 920 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-03-06 19:01:362023-03-06 19:05:36BankTalentHQ Announces Partnership with Whistle

Making Employee Retention Personal: Belonging

/wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png 0 0 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-03-05 15:47:262024-03-06 21:56:48Requesting a Physical Card

/wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png 0 0 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-03-05 15:47:262024-03-06 21:56:48Requesting a Physical Card

Employee Engagement in the Multigenerational Workplace

Great alternatives to happy hour for remote and virtual employees.

Moving Beyond Black History Month to Create an Inclusive Workplace

/wp-content/uploads/2023/02/Building-Inclusion-and-Belonging-with-Whistle-Graphic.png 300 300 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-02-17 00:19:452023-02-17 02:57:47Building Inclusion and Belonging with Whistle

/wp-content/uploads/2023/02/Building-Inclusion-and-Belonging-with-Whistle-Graphic.png 300 300 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-02-17 00:19:452023-02-17 02:57:47Building Inclusion and Belonging with Whistle

The Importance of Creating a Personalized Employee Experience – Feeling Valued

Most Leaders Focus On The Wrong Retention Problems.

Keep Your Virtual Employee Engaged During the Long Winter

/wp-content/uploads/2023/02/Time-to-democratize-culture-cover.png 300 300 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-02-03 19:43:482023-03-22 15:59:16Time to Democratize Culture Budgets

/wp-content/uploads/2023/02/Time-to-democratize-culture-cover.png 300 300 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-02-03 19:43:482023-03-22 15:59:16Time to Democratize Culture Budgets /wp-content/uploads/2023/01/Custom-dimensions920-x740px-Custom-dimensions-Custom-dimensions-Custom-dimensions.jpeg 740 920 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-01-27 22:16:412023-02-05 18:48:55Whistle System Platform Updates January 2023

/wp-content/uploads/2023/01/Custom-dimensions920-x740px-Custom-dimensions-Custom-dimensions-Custom-dimensions.jpeg 740 920 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2023-01-27 22:16:412023-02-05 18:48:55Whistle System Platform Updates January 2023

The importance of creating a personalized employee experience: Growth and Mastery

The importance of creating a personalized employee experience: Expectation and Capabilities

The importance of creating a personalized employee experience: Focus on Safety

Creating a personalized employee experience can help improve retention and loyalty

KNOWING WHERE TO INVEST YOUR CULTURE DOLLARS TO IMPROVE LOYALTY SHOULD BE YOUR #1 PRIORITY

/wp-content/uploads/2022/12/FI-Largely.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-13 11:23:192024-02-15 16:07:23Whistle partners with Largely, the Candidate & Employee Experience Platform

/wp-content/uploads/2022/12/FI-Largely.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-13 11:23:192024-02-15 16:07:23Whistle partners with Largely, the Candidate & Employee Experience Platform /wp-content/uploads/2022/12/FI-Quiet-Quitting.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-08 04:38:142022-12-11 19:31:52HOW EMPLOYEE LOYALTY SOLVES QUIET QUITTING

/wp-content/uploads/2022/12/FI-Quiet-Quitting.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-08 04:38:142022-12-11 19:31:52HOW EMPLOYEE LOYALTY SOLVES QUIET QUITTING /wp-content/uploads/2022/12/FI-Magic-Links-Whistle-App.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-02 22:23:482022-12-05 22:08:03Magic Links – New Whistle Feature

/wp-content/uploads/2022/12/FI-Magic-Links-Whistle-App.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-02 22:23:482022-12-05 22:08:03Magic Links – New Whistle Feature /wp-content/uploads/2022/12/FI-employee-loyalty-holiday-gift-ideas.png 900 1200 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-02 15:40:532022-12-02 19:09:32HOLIDAY GIFT AND PARTY IDEAS THAT DRIVE EMPLOYEE LOYALTY

/wp-content/uploads/2022/12/FI-employee-loyalty-holiday-gift-ideas.png 900 1200 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-02 15:40:532022-12-02 19:09:32HOLIDAY GIFT AND PARTY IDEAS THAT DRIVE EMPLOYEE LOYALTY /wp-content/uploads/2022/12/Jennifer-Ernst-Employee-Loyalty-Leader.png 900 1200 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-01 23:10:012022-12-02 17:55:29Employee Loyalty Leader Jennifer Ernst

/wp-content/uploads/2022/12/Jennifer-Ernst-Employee-Loyalty-Leader.png 900 1200 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-12-01 23:10:012022-12-02 17:55:29Employee Loyalty Leader Jennifer Ernst /wp-content/uploads/2022/11/Employee-Loyalty-Definition-FI-1.jpg 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-11-10 22:57:252022-11-11 00:42:25Employee Loyalty Definition

/wp-content/uploads/2022/11/Employee-Loyalty-Definition-FI-1.jpg 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-11-10 22:57:252022-11-11 00:42:25Employee Loyalty Definition

Effective Employee Loyalty Rewards Are Required to Retain Employees

/wp-content/uploads/2022/09/Metrics-FI.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-09-22 20:55:162022-09-23 16:30:38Metrics – New Feature

/wp-content/uploads/2022/09/Metrics-FI.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-09-22 20:55:162022-09-23 16:30:38Metrics – New Feature /wp-content/uploads/2022/09/Whitney-Kenter.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-09-20 01:43:072022-09-21 17:03:55Employee Loyalty Leaders with Whitney Kenter

/wp-content/uploads/2022/09/Whitney-Kenter.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-09-20 01:43:072022-09-21 17:03:55Employee Loyalty Leaders with Whitney Kenter /wp-content/uploads/2022/09/The-first-employee-loyalty-app.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-09-13 04:52:092022-09-13 05:39:544 Key Elements of an Employee Loyalty App

/wp-content/uploads/2022/09/The-first-employee-loyalty-app.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-09-13 04:52:092022-09-13 05:39:544 Key Elements of an Employee Loyalty App /wp-content/uploads/2022/09/FI-ELL-David-Klein.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-09-01 19:19:292022-09-30 17:00:27Employee Loyalty Leaders with David Klein

/wp-content/uploads/2022/09/FI-ELL-David-Klein.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-09-01 19:19:292022-09-30 17:00:27Employee Loyalty Leaders with David Klein /wp-content/uploads/2022/08/FI-Challenges-with-employee-onboarding.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-08-23 21:02:002022-08-24 14:24:22Challenges with Employee Onboarding (and How to Solve Them)

/wp-content/uploads/2022/08/FI-Challenges-with-employee-onboarding.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-08-23 21:02:002022-08-24 14:24:22Challenges with Employee Onboarding (and How to Solve Them) /wp-content/uploads/2022/08/FI-Appreciation-Gifts.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-08-18 01:05:102022-08-18 19:36:50Employee Appreciation “Gifts” Can Be Worse Than Doing Nothing

/wp-content/uploads/2022/08/FI-Appreciation-Gifts.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-08-18 01:05:102022-08-18 19:36:50Employee Appreciation “Gifts” Can Be Worse Than Doing Nothing /wp-content/uploads/2022/08/Whistle-5-Onboarding-Things_thumbnail.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-08-16 16:10:442022-08-16 21:50:30Start Doing These 5 Things When Onboarding New Employees

/wp-content/uploads/2022/08/Whistle-5-Onboarding-Things_thumbnail.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-08-16 16:10:442022-08-16 21:50:30Start Doing These 5 Things When Onboarding New Employees /wp-content/uploads/2022/07/FI-Employee-Loyalty-Katie-Harman.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-08-08 13:52:042022-09-30 17:01:36Employee Loyalty Leaders with Katie Harman

/wp-content/uploads/2022/07/FI-Employee-Loyalty-Katie-Harman.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-08-08 13:52:042022-09-30 17:01:36Employee Loyalty Leaders with Katie Harman /wp-content/uploads/2022/08/Whistle-Blog_Burnout_940x780-1.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-08-04 22:57:272022-08-05 02:03:24No One is Immune to Employee Burnout — Not Even HR

/wp-content/uploads/2022/08/Whistle-Blog_Burnout_940x780-1.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-08-04 22:57:272022-08-05 02:03:24No One is Immune to Employee Burnout — Not Even HR /wp-content/uploads/2022/07/employee-hierarchy-of-needs.png 300 300 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-07-25 18:08:332022-11-07 21:54:25The Employee Hierarchy of Needs

/wp-content/uploads/2022/07/employee-hierarchy-of-needs.png 300 300 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-07-25 18:08:332022-11-07 21:54:25The Employee Hierarchy of Needs /wp-content/uploads/2022/07/FI-Jennifer-Patterson.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-07-08 14:23:382022-09-30 17:02:42Employee Loyalty Leaders with Jennifer Patterson

/wp-content/uploads/2022/07/FI-Jennifer-Patterson.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-07-08 14:23:382022-09-30 17:02:42Employee Loyalty Leaders with Jennifer Patterson /wp-content/uploads/2022/06/FI-Rob-Seay.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-06-21 17:56:012022-09-30 17:03:48Employee Loyalty Leaders with Rob Seay

/wp-content/uploads/2022/06/FI-Rob-Seay.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-06-21 17:56:012022-09-30 17:03:48Employee Loyalty Leaders with Rob Seay /wp-content/uploads/2022/06/FI-New-Feature-Slack-Integration.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-06-01 21:31:492023-04-07 18:32:37New Feature – Slack Integration

/wp-content/uploads/2022/06/FI-New-Feature-Slack-Integration.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-06-01 21:31:492023-04-07 18:32:37New Feature – Slack Integration /wp-content/uploads/2022/05/FI-150B-industry.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-05-27 19:44:302022-05-27 20:45:03The $150 Billion Industry No One Likes

/wp-content/uploads/2022/05/FI-150B-industry.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2022-05-27 19:44:302022-05-27 20:45:03The $150 Billion Industry No One Likes

Pizza Parties Are Not the Answer to Your Retention Problems

Your Employees Are Not Quitting Because of Compensation

/wp-content/uploads/2022/03/Press-Release-1.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-03-01 16:35:112022-03-13 16:56:42Whistle Closes on $3.2 Million Seed Funding Round

/wp-content/uploads/2022/03/Press-Release-1.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-03-01 16:35:112022-03-13 16:56:42Whistle Closes on $3.2 Million Seed Funding Round /wp-content/uploads/2022/01/FI-Time-is-the-enemy.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2022-01-31 19:47:552022-02-01 20:06:42Employee Rewards: Time is the Enemy

/wp-content/uploads/2022/01/FI-Time-is-the-enemy.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2022-01-31 19:47:552022-02-01 20:06:42Employee Rewards: Time is the Enemy /wp-content/uploads/2022/01/Screenshot-2023-06-12-at-10.07.28-PM.png 780 1854 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-01-13 02:39:222023-06-13 03:15:49Data and Articles on Employee Loyalty in Banking

/wp-content/uploads/2022/01/Screenshot-2023-06-12-at-10.07.28-PM.png 780 1854 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2022-01-13 02:39:222023-06-13 03:15:49Data and Articles on Employee Loyalty in Banking /wp-content/uploads/2021/11/4-elements-of-onboarding.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-11-13 14:36:442022-09-13 05:42:48The 4 Elements of Great Employee Onboarding

/wp-content/uploads/2021/11/4-elements-of-onboarding.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-11-13 14:36:442022-09-13 05:42:48The 4 Elements of Great Employee Onboarding /wp-content/uploads/2021/11/fi-4-categories-of-learning-content.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-11-09 03:57:252021-11-09 19:46:05The 4 Categories of Learning Content

/wp-content/uploads/2021/11/fi-4-categories-of-learning-content.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-11-09 03:57:252021-11-09 19:46:05The 4 Categories of Learning Content /wp-content/uploads/2021/10/fi-microlearning-best-practices.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2021-10-14 18:00:142021-10-14 22:00:545 Microlearning Best Practices

/wp-content/uploads/2021/10/fi-microlearning-best-practices.png 780 940 Ben Valenti /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Ben Valenti2021-10-14 18:00:142021-10-14 22:00:545 Microlearning Best Practices /wp-content/uploads/2021/10/FI-Employee-Turnover-so-high.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-10-13 18:17:522021-10-14 22:02:14Employee turnover is at an all time high

/wp-content/uploads/2021/10/FI-Employee-Turnover-so-high.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-10-13 18:17:522021-10-14 22:02:14Employee turnover is at an all time high

The hidden risk of diversity training, and what you should do about it

Manager training is costing you millions, and you don’t even know it

/wp-content/uploads/2021/08/FI-Understanding-and-addressing-turnover.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2021-08-21 14:17:202021-11-28 20:02:51Understanding and Addressing Turnover in Manufacturing

/wp-content/uploads/2021/08/FI-Understanding-and-addressing-turnover.png 780 940 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2021-08-21 14:17:202021-11-28 20:02:51Understanding and Addressing Turnover in Manufacturing /wp-content/uploads/2021/08/FI-What-is-Microlearning-2.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-08-20 04:07:582021-09-22 14:25:12What is Microlearning? (And what are the benefits?)

/wp-content/uploads/2021/08/FI-What-is-Microlearning-2.png 780 940 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-08-20 04:07:582021-09-22 14:25:12What is Microlearning? (And what are the benefits?) /wp-content/uploads/2021/04/channel-learning-is-broken-whitepaper-cover.png 300 300 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-05-14 20:25:472024-01-11 21:55:12Channel Learning is Broken, and Microlearning Can Fix It

/wp-content/uploads/2021/04/channel-learning-is-broken-whitepaper-cover.png 300 300 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-05-14 20:25:472024-01-11 21:55:12Channel Learning is Broken, and Microlearning Can Fix It /wp-content/uploads/2021/05/making-friends-with-friction-cover.png 300 300 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2021-03-05 08:50:002024-01-11 21:54:47Making Friends with Friction

/wp-content/uploads/2021/05/making-friends-with-friction-cover.png 300 300 Drew Carter /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Drew Carter2021-03-05 08:50:002024-01-11 21:54:47Making Friends with Friction /wp-content/uploads/2021/03/microlearning-banner.png 480 1440 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-03-01 20:50:552022-12-08 05:03:45How Microlearning Will Transform the Sales Channel

/wp-content/uploads/2021/03/microlearning-banner.png 480 1440 Chris Dornfeld /wp-content/uploads/2024/12/Dk-Blue-Whistle-Rewards-Logo-with-Text-300x110.png Chris Dornfeld2021-03-01 20:50:552022-12-08 05:03:45How Microlearning Will Transform the Sales Channel